Let’s be honest. The process of buying a term insurance policy can feel overwhelming to many people. So many insurers, so many plans, and way too much jargon. “How much cover do I actually need?” “Which insurer will still be around 30 years from now?” “What am I missing in the fine print?”

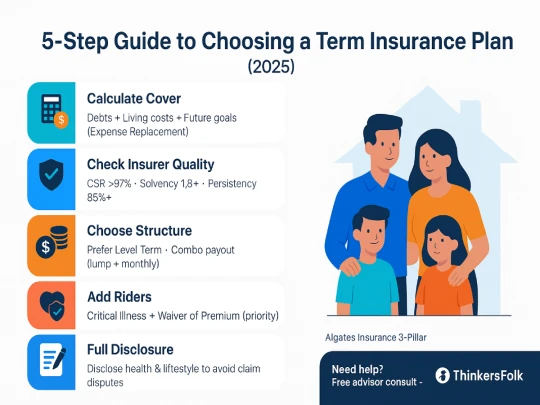

If these questions are running through your mind, you’re in the right place. This 2025 guide explains how to choose the right term insurance plan in India using the Algates Insurance Term Selection Framework, a three-step process based on your expense analysis, insurer’s stability, and smart rider selection.

You’ll learn how to:

- calculate your ideal cover

- compare insurers

- evaluate payout options

- check eligibility rules

- add riders

- and avoid the common mistakes buyers make.

Because when it comes to protecting your family, the details make all the difference.

- Calculate Cover using the Expense Replacement Method (Debts + Living Costs + Future Goals).

- Choose an Insurer by verifying CSR >97%, Solvency >1.8, and Persistency >85%.

- Select Structure: Opt for a Level Term plan with Combination Payout options.

- Add Critical Illness & Waiver of Premium Riders.

- Disclose all health/lifestyle facts during application.

How to Calculate the Right Term Insurance Cover (2025)

Term insurance cover means the total amount your family receives if you pass away during the policy term. Your sum assured isn’t a random number. It’s the amount that has to replace your financial presence for your dependents.

The old “10-15 times annual income” thumb rule might be a good starting point. But it’s too simplistic and often leaves families under-protected. Here’s a better way to think about it:

Expense Replacement Method for Accurate Term Insurance Cover

You buy term insurance so that your family meets all its future expenses comfortably, even in your absence. If you focus on this idea, the expense replacement method makes the most sense.

a) Clear All Outstanding Debts

Home loan, car loan, personal loans; your term insurance sum insured should cover everything. Your family shouldn’t be burdened with EMIs when you’re not around.

b) Replace Your Family’s Living Expenses

Calculate your family’s annual living costs today. Factor in inflation over the policy term. Historical CPI data shows 6–7% average inflation over the past decade. If your spouse needs support in the form of a retirement corpus, this becomes the biggest chunk of your cover.

c) Fund Future Goals

Children’s education, weddings, and other major life events. Estimate costs and inflate them for 10–20 years into the future.

d) Add a Buffer for Medical Emergencies & Contingencies

Final expenses, unforeseen needs, and a liquidity cushion.

Simple Example

Let’s say you’re 35 years old, earning ₹15 Lakh annually, with a ₹1 Crore home loan, two young kids, and a spouse who depends on your income.

- Debt Clearance: ₹1 Crore

- Income Replacement: ₹2+ Crores (for 25 years of income, inflation adjusted)

- Children’s Goals & Buffer: ₹50 Lakh – ₹1 Crore

Total Recommended Cover: ₹4 Crore.

This might sound like a lot. But here’s the thing: term insurance is incredibly affordable. Under-insurance is the real risk here.

How to Choose the Best Life Insurance Company in India (CSR, Solvency, Persistency)

You’re not buying a term plan for today. You’re making a promise to your family that spans decades. The insurer you choose should still be around, and still be trustworthy, 30 or 40 years from now.

Claim Settlement Ratio (CSR): The Real Test

What to Look For: A CSR consistently above 97% over at least 5 years. One good year isn’t enough. You need consistent performance. Go deeper: check both the Claim Settlement Ratio by volume (number of claims) and by value (amount settled).

Top insurers like HDFC Life, ICICI Prudential Life, and Max Life have strong CSR performance for FY25 (individual death claims).

Solvency Ratio: Financial Stability

IRDAI mandates a minimum solvency ratio of 1.5. A ratio consistently between 1.8–2 indicates strong financial cushion and claim-paying capacity.

Persistency Ratio: Are Customers Staying?

Look for high renewal rates (13th month and 61st month renewal). High persistency indicates customer trust and product satisfaction.

Grievance Redressal & Customer Service

Check IRDAI public disclosures for complaint ratios and make sure the insurer’s digital experience is smooth for premium payments and claims.

Brand Track Record

Prefer insurers with a 10+ year track record and minimal product discontinuations.

- Claim Settlement Ratio (CSR): Must be >97% consistently.

- Solvency Ratio: Must be >1.5; ideal 1.8–2.0.

- Persistency Ratio: 13th month >85%, 60th month >50%.

- Grievance Ratio: Lower is better.

- Brand History: Preferably 10+ years.

We shortlist the best insurers for you — learn about our services.

How to Choose the Right Term Plan

All term plans are not the same. Choosing the right term insurance structure can give your family crucial flexibility.

Level Term vs Increasing/Decreasing Cover

Level Term Plan: The sum assured stays constant. Ideal for most people.

Increasing Cover: The sum assured rises annually to counter inflation — useful for young buyers.

Decreasing Cover: The cover reduces annually, used mainly for loan protection.

Claim Payout Options: Important for Family’s Protection

How your family receives the sum assured is as important as the amount:

- Lump Sum: Immediate settlement—good for clearing debts.

- Monthly Income (Instalment): Regular monthly payout—recommended if you want steady replacement income.

- Combination Payout: Part lump sum + part monthly—best of both worlds.

Tip: Look for plans that let your family decide the payout mode after the claim, not one that locks a mode in advance.

Return of Premium (TROP) vs Plain Term

Plain Term: Pure risk cover; most cost-effective.

TROP: Returns premiums at maturity but costs 2–3x more and often gives poor inflation-adjusted returns. Algates recommends plain term + separate investments instead of TROP.

Term Insurance Eligibility Criteria in India (Age, Income, Medicals)

Eligibility rules determine premiums, underwriting, and acceptance. Understand them to avoid surprises.

Your Age & Policy Term

Entry age usually from 18. Premiums are lowest under 30. Policies typically cover you through earning years—consider cover till 60–70 depending on dependents.

Your Income & Sum Assured: Financial Underwriting

Insurers usually cap cover based on income—typical multipliers are:

| Age | Income Multiplier |

|---|---|

| 18–35 | 25X |

| 36–40 | 20X |

| 41–45 | 15X |

| 46–50 | 12X |

If your calculated requirement exceeds the permitted cover, consider multiple policies or top-up later when income grows.

Medical Underwriting

Medical tests may be required depending on your age and cover. The golden rule: disclose everything. Non-disclosure is the leading cause of claim rejection.

Your Job & Lifestyle: The Unseen Risk Factors

High-risk occupations or hobbies and tobacco use materially affect premiums and acceptance. Be honest in disclosure.

Eligibility Checklist

- KYC documents and income proofs

- Medical records (if any)

- Self-audit of travel, job, and health risks

5. Best Term Insurance Riders to Add (2025 Guide)

Riders enhance coverage. Choose ones that matter to you—don’t buy gimmicks.

Critical Illness Rider (Non-Negotiable)

Pays a lump sum for critical illnesses (cancer, stroke, bypass). Vital for those aged 40+. Choose riders that list 30+ conditions and pay without reducing base cover.

Waiver of Premium Rider (WoP)

If you’re diagnosed with a qualifying illness or disability, future premiums are waived and cover continues.

Accidental Death Benefit (ADB) Rider

Provides additional payout for accidental death. Low-cost and recommended if you travel often or work in higher-risk roles.

Total & Permanent Disability (TPD) Rider

Pays out if you become permanently unable to work. Check definitions carefully to avoid restrictive clauses.

Algates Recommendation: Critical Illness + Waiver of Premium is a powerful combo. Avoid unnecessary riders that inflate premium without real benefit.

Your Ultimate Term Insurance Checklist

If you are still confused, here is your one-pager term insurance checklist. Follow this checklist to avoid any mistakes during your purchase journey.

- Calculate correct cover using Expense Replacement

- Shortlist 3–4 insurers and compare CSR, solvency, persistency

- Choose Level Term with Combination payout where possible

- Add Critical Illness + WoP riders if required

- Don’t pick TROP unless you have a specific reason

- Disclose all health & lifestyle facts

Want help? Talk to an advisor — we follow the Algates 3-pillar framework to shortlist the best term plans for your needs.

Final Thoughts

The goal is to find a financially sound, ethically driven life insurer who will be there for your family decades from now. Price matters, but only after cover, insurer quality, and plan structure are decided. When chosen correctly, term insurance turns a moment of grief into one of financial security and support.